selling a car in florida taxes

License Plates and Registrations Buyers must visit a motor vehicle service center to register a vehicle for the first. The Bill of Sale form 82050 should be notarized prior to.

How To Calculate Florida Sales Tax On A Car Squeeze

Instead the buyer is.

. Average DMV fees in Florida on a new-car purchase add up to 181 1 which includes the title registration and plate fees shown above. All such certificates issued in. Florida law prohibits the parking of any vehicle on public right of ways or on private property for the purpose of sale without the permission of the property owner.

A private seller does not have the responsibility to collect sales tax from the purchasing party unless of course your income is derived from. Sale of 20000 motor vehicle to a. No discretionary sales surtax is due.

If you are a Florida resident it is mandatory for you to register your vehicle in the state of Florida within ten days of any of the above occurring even if you bought your car. You will pay less sales tax when you trade in a car at the same time as buying a new one. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

Florida Documentation Fees. Fully executed Form DR-123 must be signed at time of sale. 6 Provide the buyer with a Bill of Sale.

Once you file the Notice of Sale Form to the Tax Collectors office according to Florida. Collect the buyers home state rate up to Florida. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

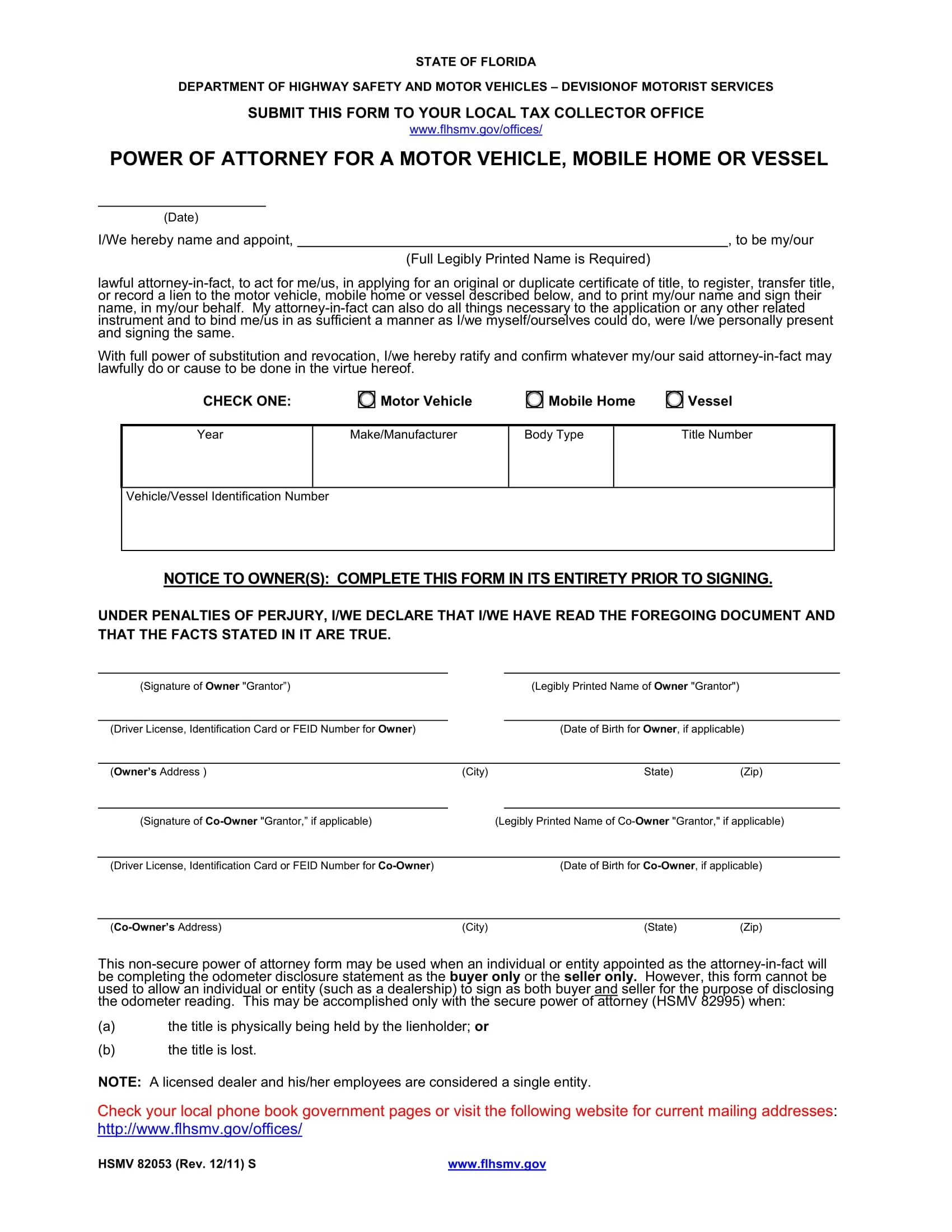

When you sell a vehicle or vessel you need to protect yourself by filing Form HSMV Notice of Sale. A state tax rate of 6 applies to all car sales in Florida but your total tax rate will vary based on county and local taxes which can be anywhere from 0 to 15. Bills of Sale are an important part of the sales process and required by law.

Required Documents in Florida. You can sell a car without tax. Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. To sell your car in Florida youll complete the Transfer of Title by Seller section on the front of your state car title certificate. If you buy a car for 30000 you would typically owe a six percent sales tax which.

Motor vehicles is 7. The buyer must pay Florida sales tax when purchasing the temporary tag. Sales to someone from a state with sales tax less than Florida.

After the title is transferred the seller must remove the license plate.

Fl Car Dealer When Is A Sale Tax Exempt James Sutton Cpa Esq

Cheapest States To Buy A Car Forbes Advisor

Virginia Sales Tax On Cars Everything You Need To Know

Used Cars In Florida For Sale Enterprise Car Sales

Best States To Buy A Car The Ultimate Guide Way Blog

Florida Vehicle Sales Tax Fees Calculator

Tax Issues In Selling A Business Vehicle

Florida Retailers Plead For Sales Tax Collections On E Commerce

Florida Vehicle Sales Tax Fees Calculator

Buying A Car In Florida From Out Of State

How Do State And Local Sales Taxes Work Tax Policy Center

Florida Sales Tax Small Business Guide Truic

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Car Buying Tips

In Florida 99 Of Companies Pay No Corporate Income Tax

Florida Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos