unfiled tax returns 10 years

The IRS cannot levy garnish or seize property while your case is pending an appeal. As a resident of Canada receiving taxable income you are obligated to file an annual T1 Income Tax Return each year.

Unfiled Tax Returns Mendoza Company Inc

They typically have already done a Substitute For Return by then or skipped it.

. The statute of limitation on collection. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing. Ad File 1040ez Free today for a faster refund.

Canadian Corporations have an obligation to file. Most IRS unfiled tax return cases are civil in nature and can be resolved but you must. In most cases the IRS requires you to go back and file your.

However you may still be on the hook 10 years later. The IRS only has ten years to collect from taxpayers but the clock doesnt start ticking until you file a tax return or the IRS files for you aka SFR. Ad Find Recommended Texas Tax Accountants Fast Free on Bark.

If you havent done one of those things the. The IRS is probably not looking for anything that is older than 10 years. E-File Your Tax Return Online.

When the Internal Revenue Service IRS conducts an audit it reviews or examines an individuals or organizations accounts and financial information in regard to their. If you dont file and owe taxes the IRS has no time limit on collecting taxes penalties and interest for each year you did not file. However since the tax return was never filed - that statute may not be applied and the IRS may assess additional tax liability at any time.

The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns.

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

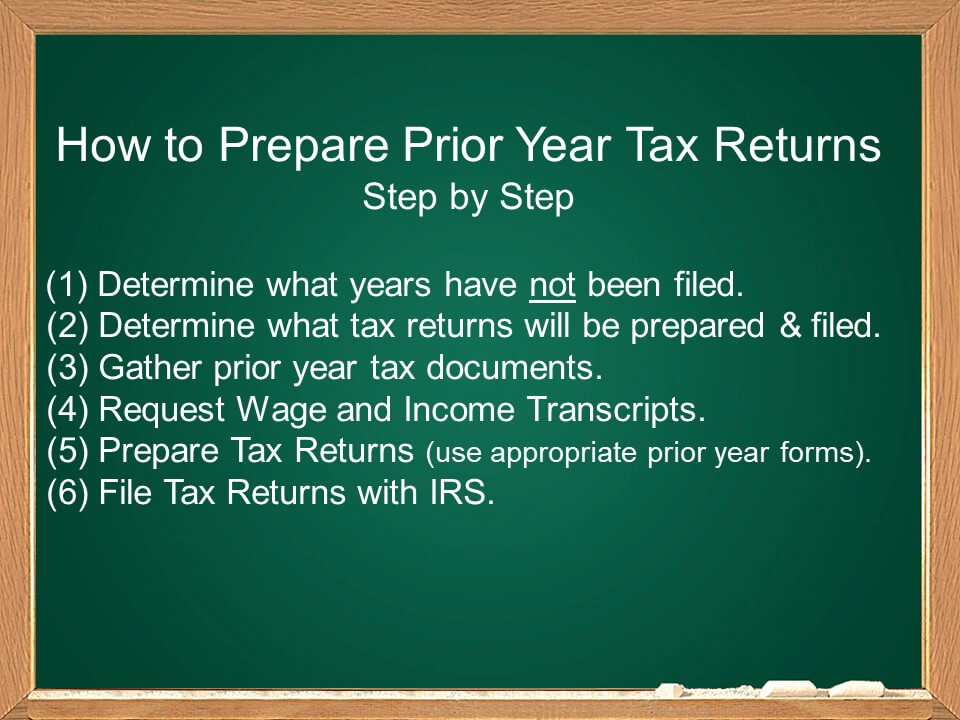

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

How Far Back Can The Irs Collect Unfiled Taxes

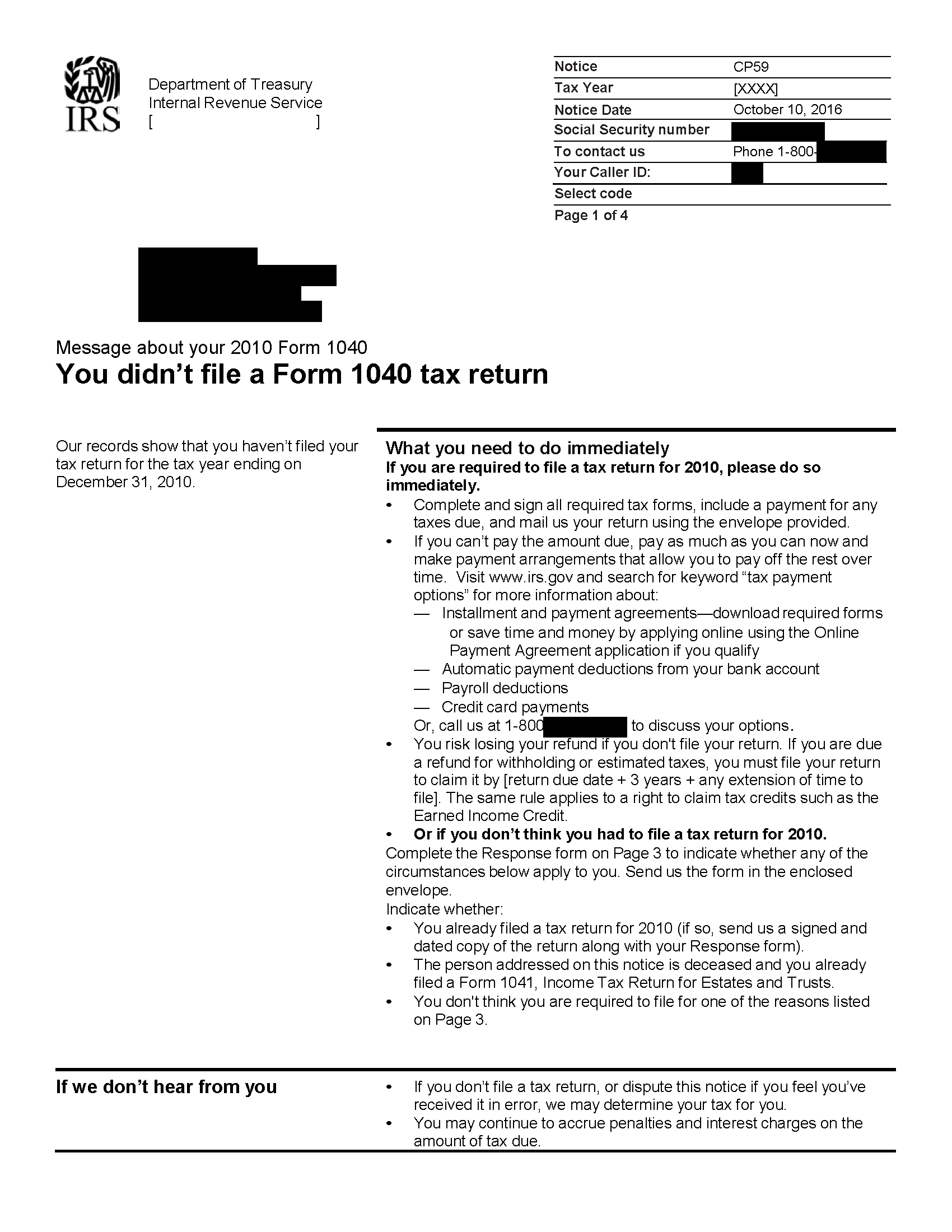

Irs Notice Cp59 Form 1040 Tax Return Not Filed H R Block

Unfiled Irs Tax Returns Best Tax Relief Company Is

Unfiled Tax Returns Premier Tax Solutions

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Irs Letter 5972c You Have Unfiled Tax Returns And Or An Unpaid Balance H R Block

Unfiled Tax Returns Tax Champions Tax Negotiation Services

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

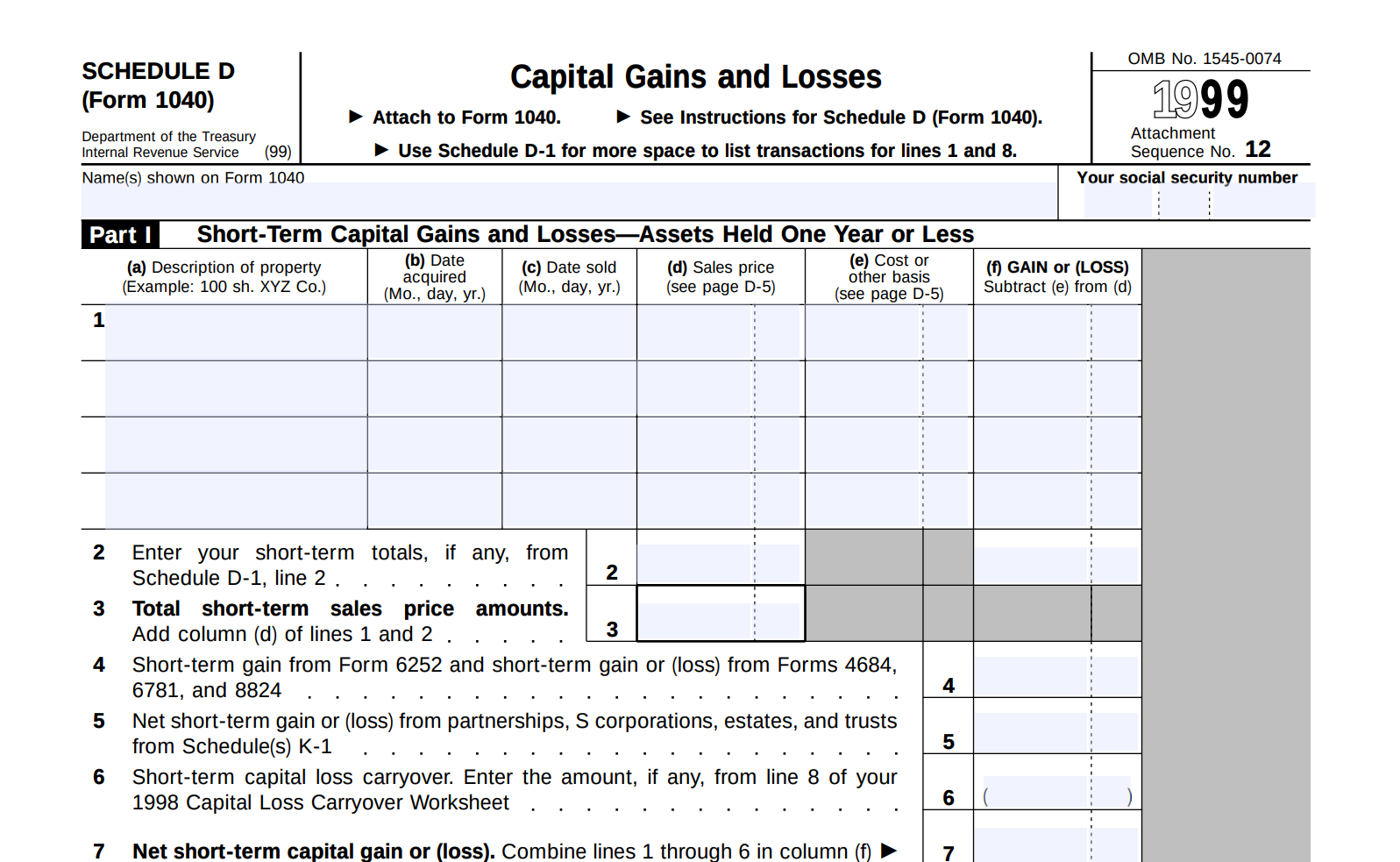

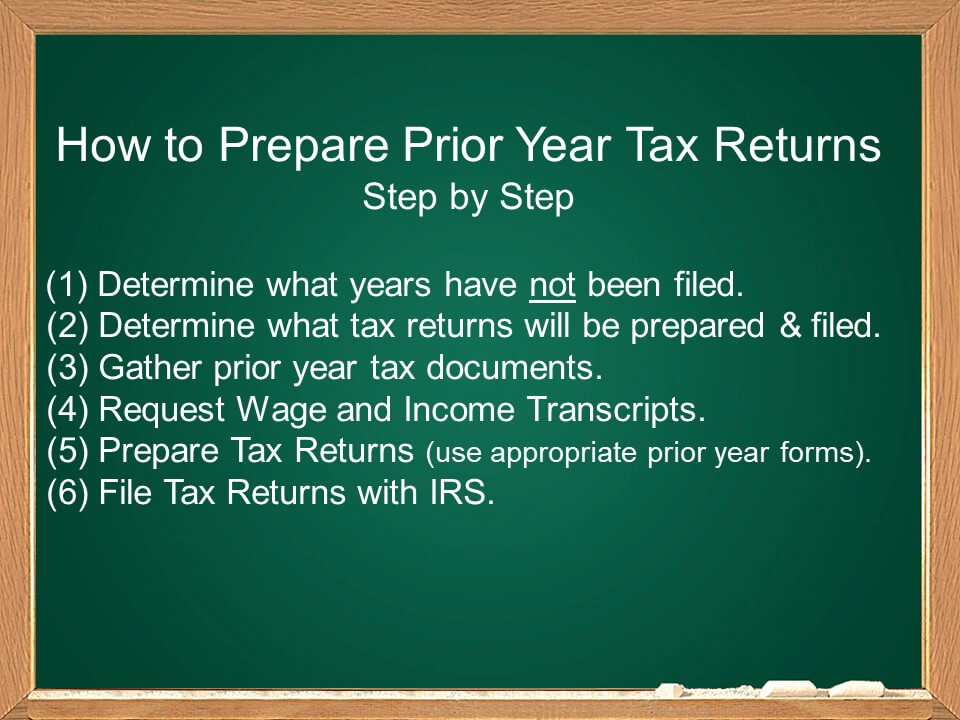

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns